Below is our recent interview with Eva Epker, Director of Marketing at Avestria Ventures:

Q: Could you provide our readers with a brief introduction to your company?

A: Avestria Ventures is a venture capital firm that was started in 2019 by two Harvard Business School classmates and veteran life science executives: Corinne Nevinny and Linda Greub. Avestria focuses on early-stage female-led life science ventures and women’s health companies, which we define as companies addressing health issues that affect women exclusively (such as menopause), disproportionately (like Alzheimer’s), or differently from men (like heart disease). Our portfolio, which – including our two exits – includes 16 companies are split among those two investment areas. For more information on what we look for in a potential investment and which companies are in our portfolio, you can also visit our blog or website.

Q: Any highlights on your recent announcement?

A: We’re really excited about our two exits – Alydia Health and Uqora, which were acquired by Organon and Pharmavite respectively – because they show that there is an appetite for acquisitions in the women’s health space. In fact, both acquirers have been public about their desire to address the women’s health market: Organon is committed to listening to women’s voices and addressing their needs while Pharmavite noted its desire to expand its women’s health offerings. While women are the dominant users, workers, and decision-makers in healthcare, women’s health has, again and again, been dismissed as a “niche” market. That these major players have expressed the value they see in women’s health companies, we hope, will encourage other investors and strategics to follow suit.

Recommended: Diptera.ai Disrupts The $100 Billion Pest Control Market By Democratizing Sterile Insect Technique

Recommended: Diptera.ai Disrupts The $100 Billion Pest Control Market By Democratizing Sterile Insect Technique

Q: Can you give us more insights into your offering?

A: Members of the Avestria team have spent 30+ years in healthcare investment and operations: expertise that is unique within the venture community. We focus on early-stage companies because we believe that we can provide the most value to companies at that stage: we can help them with their operating needs and questions, make introductions in our network of life science colleagues, and pull on our own experiences to help make our portfolio companies as successful as possible.

Q: What can we expect from your company in the next 6 months? What are your plans?

A: Our first fund, Avestria Ventures Fund I, closed after our first exit, and we’re hoping to build off that momentum for Fund II. Some of our portfolio companies are also projected to hit major milestones in the next six months, and we’re looking forward to seeing their progress.

Recommended: Digital Transformation Brings Businesses More than Just Cost Cuts

Recommended: Digital Transformation Brings Businesses More than Just Cost Cuts

Q: What is the best thing about your company that people might not know about?

A: One fact that most people don’t know is the origins of our name. “Avestria” is based on two words: the word “invest” and the Sanskrit word for girl/woman. Together, those two words summarize our investment thesis: both female founders and women’s health companies haven’t seen the level of investment that we believe is consistent with their market potential.

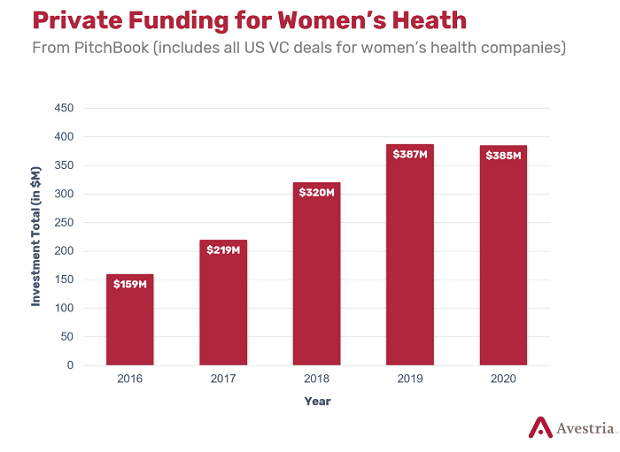

For example, female-led teams outperform all-male teams across metrics including ROI, valuations, and revenue generated per dollar raised, but female founders received about 2.3% of all venture capital dollars in 2020: down from an all-time-high of about 2.8% in 2019. For black female founders, that percentage for 2020 is only 0.64%. Likewise, according to CB Insights, women’s health companies raised collectively $1.68 billion in 2020 – only about 10% of the total funding that all venture capital-backed companies raised that year – though their target market is about 50% of the world’s population.

Our investment thesis – as well as our name – thus reflects our belief that women’s health and female founders are two areas that have been undervalued and are ripe for innovation and investment.