Zopa, a leading neobank in the UK, has announced a significant milestone in its journey. With a history dating back to 2004, the company has shown resilience and innovation in the ever-evolving financial sector. Here’s a closer look at Zopa’s recent achievements and what they mean for the future of neobanking.

A Leap in Valuation

In 2021, Zopa saw a dramatic increase in its valuation, reaching the $1 billion mark. This surge was primarily due to a substantial investment from SoftBank and the company’s aspirations to go public by 2022. While the IPO markets remain uncertain, Zopa’s growth trajectory continues to impress.

Recent Fundraising Efforts

As of 2023, Zopa has secured a debt fundraise of £75 million ($93 million) . This fund will be instrumental in strengthening the company’s financial position, exploring potential acquisitions, and expanding its product range. Notably, this comes after an equity tranche of the same amount raised about seven months prior, led by IAG SilverStripe. To date, Zopa has raised a whopping £530 million.

The Rise of Debt Financing

While many startups are grappling with the challenges of equity-based funding, debt financing is gaining traction. Recent reports suggest that debt has slightly overtaken equity as the primary source of startup funding. Zopa’s decision to opt for debt financing stems from its robust cash generation and growth, making a compelling case for its ability to repay the borrowed amount. The company has already achieved EBITDA positivity and is on the path to profitability this year, with projections indicating a potential annualized run rate of £250 million ($312 million).

Focus on the UK Market

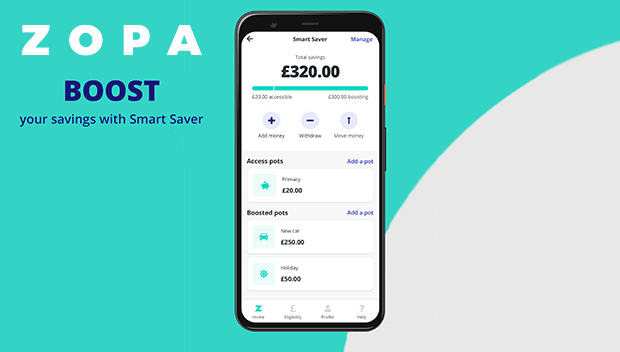

Despite its success, Zopa has no immediate plans to venture outside the UK. Jaidev Janardana, the CEO, emphasizes the vast opportunities within the UK, negating the need for international expansion in the near future. This year, Zopa introduced two new products – a Buy Now Pay Later (BNPL) service and a long-term savings account known as ISA. The company aims to launch two more products next year as it patiently awaits favorable IPO conditions.

Zopa’s journey reflects the dynamic nature of the financial sector and the potential of neobanks. With a clear focus on innovation and customer-centricity, the company is poised for even greater achievements in the coming years.

Please email us your feedback and news tips at hello(at)techcompanynews.com