Below is our recent interview with Nik Zimarkov, the CEO at Karta.io:

Q: Nik, can you tell us something more about your company?

A: Karta.io is a financial platform designed to eliminate the financial chaos of e-commerce businesses, giving them complete control over their finances and enabling them to reach financial oversight, eliminate manual work and focus on growth. In point of fact, our service was the reasonable answer to slow banks and painful managing a bunch of narrowly focused services that don’t offer a big picture, so we created a flexible solution that transforms a traditionally complex process into a streamlined, efficient budgeting. Now, Karta delivers to businesses automation and control of financial processes while gaining traction in the snowballing e-commerce market.

Q: Any highlights on your recent announcement?

A: We’ve recently hit the US market and made it easy to open a business account for incorporated businesses, individuals, and sole proprietors — in 5 minutes, with no paperwork and crossed fingers while waiting.

For many months, we’ve been developing flexible budgeting features to make finance team management smooth sailing for any company. That way, business owners can tailor services for themselves and delegate spending to staff, get insights into their business and switch from management to strategy.

Q: Can you give us more insights into your offering?

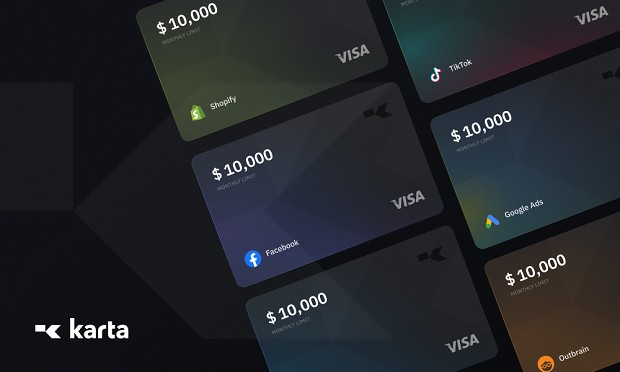

A: With fast-created business accounts, we offer virtual cards with spending rules for every user and expense level: subscription payment, advertising expenses, and more. Cards can be created and managed in budgets that are set for each team, project or vendor. Any business owner can add an employee, customize the rules and limits and set up a manager. That way, teams get traceable and secure payments, and business owners see the big picture of their company’s expenses with real-time expense tracking.

We’ve also recently launched a full payments hub for all Karta customers: it’s easy to move money with ACH and wires, pay and get paid, make invoices, create sub-accounts, and more.

Q: What can we expect from your company in next 6 months? What are your plans?

A: First and foremost, with sufficient funding, we will expand internationally and capture overseas markets.

We’re continually working to improve our product, so keep an eye out for new developments in the credit hub. In the coming months, we’re building advanced reports and metrics inside our app to get more insights about our customers’ spending categories and trends. This will make it easier for us to focus our efforts on providing customers with tailored services and products, and for our customers — to easily apply for loan or credit. We have a long journey ahead of us, but we are excited for what’s to come.

Recommended: Hula Data Network Engineering

Recommended: Hula Data Network Engineering

Q: What is the best thing about your company that people might not know about?

A: We started out as an agency for performance marketing, focusing on e-commerce clients who spend a lot on advertising, and this helped us develop our solution for this industry. It was because we saw that solutions on the market were 10 years behind, and in the conditions of such a rapidly growing market as e-commerce, you need to be 2 steps ahead — that’s why we’re constantly innovating and communicating with customers, developing fast so we can meet their real needs. These efforts have resulted in a product that is relevant today, and in the future.

We’re a globally diverse, technically skilled, and incredibly passionate team of employees who love our product and deeply believe that it will change the rules of the fintech game. We’re constantly brainstorming ways to improve our product and adapt our experience to the fintech market. It’s challenging, but definitely worth it.

Recommended:

Recommended: