Zest Equity is making waves in the private market sector. With a fresh injection of seed funding, the startup is poised to further digitize and streamline the world of private market dealings.

A Glimpse into the Funding Round

Zest Equity, has successfully secured $3.8 million in seed funding. This funding aims to develop advanced tools that facilitate swift, transparent transactions for ecosystem players. Moreover, it seeks to enhance liquidity through secondary deals.

The seed funding round witnessed leadership from Middle East Venture Partners (MEVP). Notable participants included the Dubai Future District Fund (DFDF) and DASH Ventures. With this latest financial boost, Zest Equity’s total funding now stands at an impressive $5.7 million.

The Genesis of Zest Equity

Founded in 2021 by Rawan Baddour and Zuhair Shamma, Zest Equity initially emerged as a marketplace for secondary trading. However, its rapid evolution saw it transform into a platform that empowers ecosystem players, such as founders and venture capitalists, to conduct transactions swiftly and transparently online. This is a significant shift from the traditional offline, often cumbersome and expensive, transaction methods.

The motivation behind this transformation? A glaring absence of infrastructure that promotes efficient communication, connectivity, and information sharing in a digital, cost-effective manner.

A Tech-First Approach to Private Market Dealings

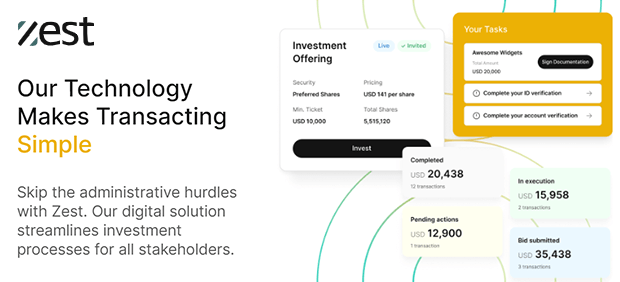

Rawan Baddour, a former banking executive and Co-Founder of Zest Equity, emphasized the company’s commitment to digitization. “We’re digitizing a lot of what is actually very manual,” Baddour shared with TechCrunch. The goal? To automate as much as possible, crafting a platform that’s both unique and scalable.

Zest Equity offers a suite of tools for founders, allowing them to invite investors to fundraising rounds, disseminate vital information like pitch decks and cap tables, and monitor deal progress. On the flip side, investors can express their interest, view other participating VCs, and finalize documents with ease.

Legal Infrastructure and New Tools on the Horizon

Zest Equity doesn’t stop at digital tools. They also provide the necessary legal infrastructure, enabling investors to form investment groups or special purpose vehicles. This approach not only saves time and administrative costs but also simplifies the investment process, especially for angel investors.

With the recent funding, Zest Equity plans to develop even more tools to further streamline the process. One such initiative includes tools that standardize the process for secondary share trade, ensuring transparency, expediting sale approvals, and simplifying liquidity access for investors.

Zest Equity’s Growing Impact and Future Plans

Walid Mansour of MEVP highlighted Zest Equity’s rapid ascent as a reliable solution for digitizing private market transactions in the Middle East. As startups and investors continue to mature, the demand for such solutions is only set to grow.

With an eye on expansion, Zest Equity is targeting emerging markets, including North Africa, South Asia, and Turkey, identifying similar market gaps and challenges.

In conclusion, Zest Equity’s innovative approach to private market transactions is setting new standards in the industry. With its recent seed funding and a clear vision for the future, the startup is well on its way to reshaping the landscape of private market dealings.

Please email us your feedback and news tips at hello(at)techcompanynews.com