Below is our recent interview with Ben Smith, the President at AmeriStar Investment:

Q: Could you provide our readers with a brief introduction to AmeriStar Investment?

A: Absolutely. AmeriStar is a seasoned financial service provider, located in the United States. Originally, we dealt simply with SEC Regulation D 506(c) private issuances, mostly in the real estate arena. We had great success with that over the past ten years.

Our parent holding company is TPA Gold Corporation, which is a Hong Kong based private precious metal dealer that provides institutional precious metals sales world-wide. Of course with TPA Gold backing AmeriStar, our pocket books are quite large.

We recently went more mainstream and started offering Regulation 506(b) investments, tied in with Certificate of Deposits.

Q: Who is your ideal client and why?

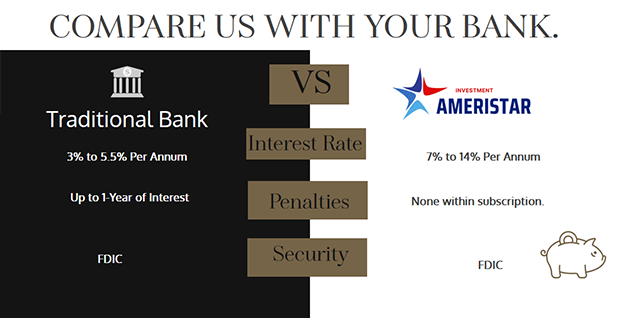

A: Our ideal client is an accredited investor who is simply not happy with the basic, minimal returns they are receiving at a bank or brokerage. Whether that’s a traditional savings account or money market account.

Let’s face it, even with basic banking knowledge, an investor knows that if they buy a Certificate of Deposit from a bank, the bank is going to loan the investors money right back out, at a higher interest rate. Its banking 101. Investors are okay with this because they don’t have other options, and they want security. Our High-Yield Certificate of Deposit Program provides F.D.I.C insurance for security, but also great yields.

Q: Can you tell us more about your services?

A: We offer a variety of SEC registered regulation D investment opportunities, including High-Yield Certificates of Deposit, real estate and precious metals.

Q: What can we expect from AmeriStar Investment in next 6 months? What are your plans?

A: Right now we are really focused on the High-Yield Certificates of Deposit and reaching as many accredited investors as we can. Based on our launch, we really think that we will be able to have this offering completely subscribed in record time, and then launch a second. Our estimation is that for both offerings, $1B AUM in that specific program is likely within 6 months.

Q: Is it true that you can invest with crypto currencies?

A: Yes! We accept crypto currencies that have a trading market value. What does that mean? Put simply, we can’t accept a Alt Coin that is not liquid.

Q: Why should an investor choose your High-Yield Certificates of Deposit instead of the stock market?

A: Well, they shouldn’t. The stock market is an investment based on speculation, our High-Yield Certificates of Deposit Program can’t compete with that, because its not based on speculation. It’s based on security.

However, any investment advisor will tell investors their portfolio needs to be diversified, and not all in stocks or bonds for example. What they don’t tell investors, is that keeping all of an investors assets at one brokerage, or with one investment advisor, well that’s not diversification. That’s segmentation. However, investment advisors make fees based on the AUM they hold, so they are never going to tell an investor to put 50% with them, 25% with Bank A, and 25% with Bank B.

AmeriStar can be a great addition to a rounded, diversified portfolio, not a replacement for stock investing.

Q: What is the best thing about AmeriStar Investment that people might not know about?

A: Because AmeriStar is not a Registered Investment Advisor or Broker Dealer, we are not bound by one specific custodian. That really helps us get the absolute best rates on Certificates of Deposits for our investors.