FinFloh revolutionizes accounts receivable management by leveraging AI and automation to streamline processes, enhance cash flow, and improve operational efficiency for CFOs and finance teams. Its seamless integration with existing ERP and CRM systems, alongside sophisticated buyer intelligence and collaborative communication platforms, empowers businesses to manage receivables more effectively. As a testament to its founders’ vision, FinFloh is setting new standards in financial operations, promising a future where financial management is not only efficient but also strategic.

Introduction: The Game-Changer in Accounts Receivable Management

The landscape of financial operations, particularly within the domain of accounts receivable (AR), has long been fraught with inefficiencies. Traditional methods, heavily reliant on manual intervention and fragmented systems, often lead to increased days sales outstanding (DSO), strained cash flows, and operational bottlenecks. Enter FinFloh, an innovative platform designed to address these challenges head-on by harnessing the power of artificial intelligence (AI) and automation. This solution stands as a beacon for CFOs and finance teams, promising not just to streamline AR processes but to transform them into strategic assets for the business.

Why FinFloh is a CFO’s Best Friend

The essence of FinFloh’s appeal lies in its direct impact on two critical aspects of business finance: cash flow and operational efficiency. By automating the AR process, FinFloh significantly reduces DSO, thereby enhancing a company’s liquidity. This liquidity, in turn, can be reinvested into the business, fueling growth and stability. Feedback from finance leaders who have integrated FinFloh into their operations underscores its effectiveness, with many reporting substantial improvements in their financial metrics.

Breaking Down the AI Advantage

FinFloh’s AI-driven approach to collections and follow-ups represents a paradigm shift in how businesses manage their receivables. The platform’s algorithms analyze buyer behavior, payment histories, and risk profiles to tailor follow-up strategies that are both efficient and effective. This customization ensures that high-risk accounts receive more attention, while low-risk accounts are managed with minimal intervention. The result is a significant reduction in DSO and an increase in overall collections efficiency.

- Key Benefits:

- Reduction in manual follow-up tasks

- Tailored collection strategies for different risk categories

- Enhanced decision-making through AI-driven insights

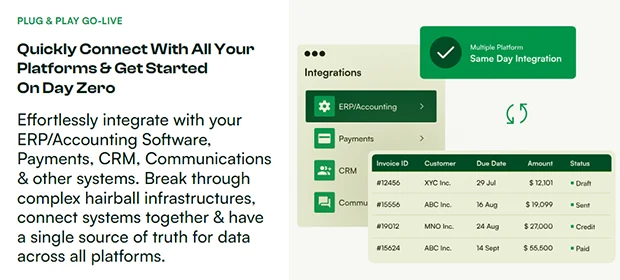

Seamless Integration: The End of Manual Overheads

One of FinFloh’s most compelling features is its ability to seamlessly integrate with a wide array of ERP and CRM systems. This interoperability eliminates the data silos and manual data entry that plague many finance departments. With FinFloh, information flows freely between systems, ensuring that finance teams have access to real-time data. This integration not only streamlines the AR process but also provides a foundation for more strategic financial management practices.

Recommended: Canonic Is Redefining The Landscape Of App Development With Its User-Friendly, No-Code Platform

The Power of Buyer Intelligence in Your Hands

At the heart of FinFloh’s platform is a sophisticated buyer intelligence system that leverages market insights and receivables data to empower businesses with actionable credit insights. This system enables finance teams to make informed decisions about credit terms and limits, reducing the risk of bad debt. Additionally, the platform’s predictive analytics capabilities allow for more accurate cash flow forecasting, giving businesses a clearer picture of their financial future.

- Strategic Insights Offered by FinFloh:

- Credit risk assessment based on comprehensive buyer data

- Predictive modeling for cash flow forecasting

- Enhanced visibility into buyer payment behaviors and trends

Collaboration Like Never Before: Solving Disputes with Ease

FinFloh redefines the approach to resolving disputes and accelerating payment processes through its collaborative communication platform. This feature facilitates seamless interaction between finance, sales, customer support, and the buyers themselves, ensuring that disputes are resolved swiftly and efficiently. By assigning clear ownership and timelines for each dispute, FinFloh minimizes the time spent in resolution and maximizes the speed of payment. The platform’s ability to break down silos within an organization not only improves operational efficiency but also enhances customer relationships by providing a more responsive and effective dispute resolution process.

From Vision to Reality: The Founders’ Journey

The inception of FinFloh is a testament to the vision and perseverance of its founders, Amartya Singh and Shivam Rawat. Their journey from identifying a gap in the market to creating a solution that addresses one of the most pressing challenges in business finance is both inspiring and instructive. Their backgrounds, combining deep tech expertise with extensive experience in fintech and payment solutions, provided the perfect foundation for developing FinFloh. The platform’s success is a reflection of their commitment to leveraging technology to solve real-world problems, transforming the way businesses manage their receivables and cash flow.

Empowering Businesses Worldwide: A Look at FinFloh’s Global Reach

FinFloh’s scalability and adaptability have enabled it to serve a diverse range of businesses across the globe, from startups to multinational corporations. The platform’s flexibility allows it to cater to the unique needs of different industries and business sizes, making it a versatile tool for any organization looking to improve its AR processes. Success stories from various parts of the world highlight FinFloh’s ability to adapt to different regulatory environments and business practices, underscoring its potential as a global solution for AR management.

The Future of Financial Operations: Beyond Accounts Receivable

While FinFloh currently focuses on revolutionizing AR management, its potential applications extend far beyond. The platform’s core technologies—AI, machine learning, and data analytics—have the capacity to transform other areas of financial operations, from payable management to financial forecasting. As FinFloh continues to evolve, it is poised to offer even more comprehensive solutions that address a wider range of financial challenges, further solidifying its position as a leader in the fintech space.

Unlocking the Full Potential of Your Financial Operations

FinFloh stands at the forefront of the fintech revolution, offering businesses a powerful tool to optimize their AR processes, improve cash flow, and enhance operational efficiency. Its combination of AI-driven insights, seamless integrations, and collaborative communication platforms makes it an invaluable asset for any finance team. As businesses look to navigate the complexities of the modern financial landscape, FinFloh offers a clear path to success, empowering them to achieve their financial goals and drive growth. With FinFloh, the future of financial operations looks brighter than ever, promising a world where financial management is not just efficient but strategic.

Please email us your feedback and news tips at hello(at)techcompanynews.com