FlexPoint has secured $35 million in funding to enhance its payment automation platform for managed service providers (MSPs), signaling a transformative shift in financial management within the sector. This investment will fuel innovation, expand services, and solidify FlexPoint’s position as a key player in streamlining billing processes and improving cash flow for MSPs and their clients. Backed by prominent investors, FlexPoint is set to redefine efficiency and operational success for the MSP community.

Revolutionizing the Payments Landscape

In an era where digital transformation dictates the pace of business operations, FlexPoint emerges as a beacon of innovation in payment automation. The recent infusion of $35 million in funding marks a pivotal moment for FlexPoint, setting the stage for a new chapter in financial management for managed service providers (MSPs). This significant capital injection is not just a vote of confidence from the investment community but a testament to FlexPoint’s potential to redefine the payments automation sector.

FlexPoint Unpacked: A Closer Look at the Game-Changer

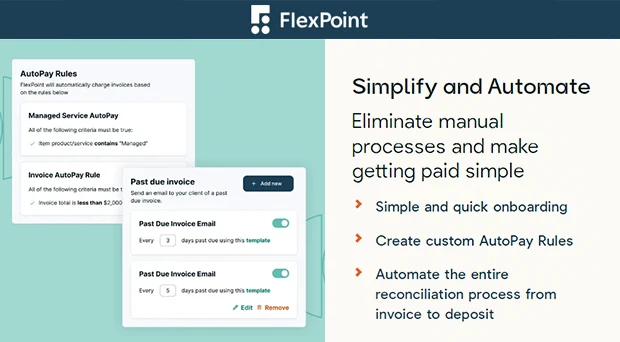

FlexPoint distinguishes itself by tailoring its payments automation platform to the unique needs of MSPs and their clients. At its core, FlexPoint simplifies the complex financial operations of MSPs through a suite of robust automations and deep integrations. This approach ensures payments are processed seamlessly, enhancing cash flow management and operational efficiency. The platform’s ability to transform billing processes was recently illustrated by the experience of Compunet Technologies, a FlexPoint partner. Where billing once consumed hours of administrative work, FlexPoint reduced this task to mere minutes, underscoring the platform’s impact on productivity and financial management.

The $35 Million Boost: What It Means for FlexPoint and MSPs

The recent fundraising is a composite of $5 million in equity led by Haymaker Ventures and a substantial $30 million credit facility from Tacora Capital. This strategic allocation of funds is earmarked for several key areas:

- Expansion of Services: Enhancing the existing payments platform to offer more comprehensive financial solutions for MSPs.

- Innovation and Development: Fueling the creation of new features and capabilities that will further streamline payment processes for MSPs and their clients.

The infusion of capital is expected to catalyze growth for FlexPoint, enabling it to scale its operations and extend its reach within the MSP community. For MSPs, this translates to improved access to working capital, facilitating smoother business operations and fostering growth.

Behind the Scenes: The Investors Betting Big on FlexPoint

Haymaker Ventures, alongside Garuda Ventures, Far Out Ventures, and Cascade Seed Fund, represent the cornerstone investors in FlexPoint’s vision. Their financial backing is a clear indicator of their belief in FlexPoint’s mission and its capacity to revolutionize financial management for MSPs. The investors’ confidence is grounded in FlexPoint’s innovative approach to addressing the challenges of payment automation, showcasing the platform’s potential to significantly enhance MSP operations.

Recommended: How IO Research’s Latest $30M Funding Fuels The Future Of AI And Blockchain

Transforming MSP Operations: Before and After FlexPoint

The impact of FlexPoint on MSP operations is profound, marking a before and after in how financial transactions and billing are managed. Prior to adopting FlexPoint, many MSPs grappled with inefficient, time-consuming billing processes that strained their resources. In stark contrast, post-implementation stories highlight a transformative change:

- Efficiency in Billing: The reduction in time spent on billing from hours to minutes not only boosts productivity but also allows MSPs to redirect focus towards growth and service improvement.

- Enhanced Cash Flow Management: With more efficient billing cycles, MSPs experience improved cash flow, essential for the health and expansion of their operations.

FlexPoint’s Vision: Beyond the $35 Million

With the recent funding, FlexPoint is not merely looking to expand its current offerings but is also setting its sights on a future where its platform becomes integral to the MSP ecosystem. Plans include:

- Expanding Market Reach: Broadening its footprint to serve more MSPs and their business clients across diverse sectors.

- Continued Innovation: Developing new features and capabilities that further simplify and enhance the financial operations of MSPs.

FlexPoint envisions a future where its platform is synonymous with MSP success, characterized by seamless financial transactions, optimized cash flow, and enhanced operational efficiency.

Riding the Wave of Innovation: The Future Looks Bright

The trajectory for payment automation and FlexPoint’s role within it is marked by optimism and growth. As digital transformation accelerates, the demand for efficient, reliable payment solutions will only increase. FlexPoint is well-positioned to lead this charge, offering MSPs a tool that not only meets their current financial management needs but also adapts to future challenges.

A Leap Towards Seamless Financial Management

In summary, FlexPoint’s recent $35 million funding milestone is a clear indicator of its potential to revolutionize payment automation for MSPs. By providing a platform that enhances efficiency, improves cash flow, and supports growth, FlexPoint is paving the way for a new era of financial management. The support from key investors underscores the platform’s value and the confidence in its future success. As FlexPoint continues to evolve and expand, its impact on the MSP ecosystem and the broader tech industry is poised to grow, marking a significant step forward in the journey towards seamless financial management.

Please email us your feedback and news tips at hello(at)techcompanynews.com