Slope, an innovative business-to-business payments platform, has successfully secured a venture round of $30 million. This significant funding will be channeled towards expanding its operations and enhancing product development, especially as the company shifts its focus to larger enterprise clients.

Digitizing the B2B Payments Landscape

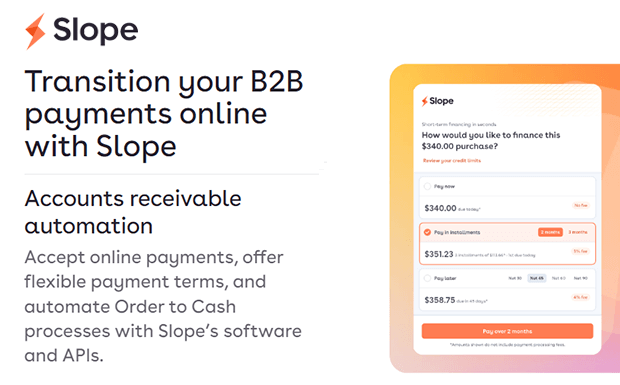

Since its inception in 2021 by Co-Founders Lawrence Lin Murata and Alice Deng, Slope has been on a mission to revolutionize the massive $125 trillion B2B payments market. At the heart of Slope’s groundbreaking technology lies the order-to-cash workflow automation. This system harnesses the power of artificial intelligence, offering tools for seamless checkout, comprehensive customer and vendor risk assessment, efficient payment reconciliation, and effective cash management.

SlopeGPT: A New Era in Payments Risk Model

Slope’s recent product, SlopeGPT, stands out as the first-ever payments risk model powered by GPT. Murata emphasizes the company’s deep-rooted involvement in AI, which predates the current AI hype. He mentions, “As we collect more data, we are able to leverage larger and larger models.” This approach has enabled Slope to build on top of GPT embeddings specifically for payments risk, a crucial application for successful transactions.

Investment Highlights

Slope’s journey has been marked by significant milestones, including an $8 million seed round in 2021 and a $24 million Series A funding in 2022. The recent funding round, led by Union Square Ventures and featuring major participation from OpenAI’s Sam Altman, underscores the company’s potential. Altman expressed his confidence in Slope’s vision, stating, “Slope’s quest to reshape the B2B payments experience and bring the sector into the digital age is audacious — and that’s why I chose to back them.” The investment round was highly competitive, with Slope receiving multiple offers and being oversubscribed several times.

From Startups to Enterprises

Initially, Slope collaborated with startups. However, the company’s customer pipeline has now evolved to cater mainly to enterprises, including notable names like Fiserv. This strategic shift has resulted in a staggering 17x increase in both volume and company revenue since the previous year. Deng, reflecting on this growth, shared insights with TechCrunch about the company’s vision for a smooth transition to the digital B2B payments world.

Slope envisions a future where AI doesn’t merely stand at the forefront of the user experience but acts as an invisible force, streamlining and automating processes. As the company continues its journey, it remains committed to ensuring that users experience the benefits of technology, even if they remain oblivious to the intricate workings behind the scenes.

Please email us your feedback and news tips at hello(at)techcompanynews.com