A Significant Funding Milestone

Plan A, a European-based carbon accounting and ESG (environmental, social, and governance) platform, has successfully secured $27 million in a Series A funding round. This round was spearheaded by the renowned U.S. venture capital firm, Lightspeed Venture Partners. This recent funding is an extension of a previously announced $10 million Series A round, bringing the total for this round to $37 million. Over its six-year journey, Plan A has amassed a total of $42 million in funding.

Corporate Giants Join the Green Movement

Notably, this funding round witnessed participation from major corporate entities. Giants like Visa, Deutsche Bank, and BNP Paribas’ VC arm, Opera Tech Ventures, have shown their support, alongside several angel investors. Lubomila Jordanova, the CEO and Founder of Plan A, emphasized the urgency of addressing the climate crisis and the challenges businesses face in achieving net-zero emissions.

Plan A’s Origin and Mission

Established in Berlin in 2017, Plan A’s mission revolves around assisting companies in measuring and reducing their carbon footprints. A significant challenge that many companies face is accurately measuring their greenhouse gas emissions. A survey by Boston Consulting Group highlighted that a staggering 90% of organizations do not comprehensively measure these emissions. Plan A’s platform addresses this by helping companies identify emissions throughout their supply chain, especially the often overlooked “scope 3 emissions.”

The Importance of Scope 3 Emissions

Scope 3 emissions, which pertain to emissions in the supply chain involving partner businesses, often constitute a significant portion of a company’s total carbon footprint. For instance, Coca-Cola European Partners estimated that 93% of its emissions were scope 3. Addressing these emissions is crucial as global energy-related CO2 emissions saw a growth of 0.9% in 2022.

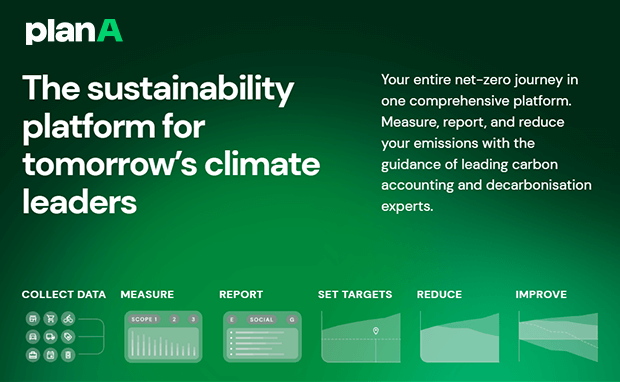

Plan A’s Innovative Solution

To combat these challenges, Plan A has introduced a SaaS-based sustainability platform. This platform empowers companies to manage their journey to net-zero emissions. It offers features like data collection, emissions calculation, target setting, and decarbonization planning. Importantly, it maps emissions data across all scopes (1, 2, and 3) and aligns them with global scientific standards. Companies like BMW, Deutsche Bank, KFC, and Visa are already leveraging Plan A’s platform, either through its web app or its API.

Expansion and Future Goals

With a team of 120 employees spread across Berlin, Paris, and London, Plan A is poised for growth. The recent funding will be channeled towards doubling their team size, enhancing their platform’s capabilities, and expanding their market presence in Europe, focusing on regions like France, the U.K., and Scandinavia.

The Rising Trend of Climate Tech Startups

The funding landscape for climate-tech startups remains promising. While there has been a decline in later-stage funding, early-stage investments appear robust. ESG data startups, in particular, are witnessing significant demand. The increasing severity of the climate crisis, coupled with regulatory pressures, is driving investments in this sector. European governments are also playing a pivotal role by implementing policies that favor clean tech and attract investors.

Final Thoughts

The climate challenge remains at the forefront of global concerns. As Julie Kainz from Lightspeed aptly stated, the pressure from consumers regarding climate change will only intensify in the coming decades. With startups like Plan A leading the charge, there’s hope for a greener, more sustainable future.

Please email us your feedback and news tips at hello(at)techcompanynews.com