Ramp recently secured $150 million in a Series D-2 funding round, led by prominent investors, signaling strong confidence in its financial technology solutions. This funding will enable Ramp to enhance its comprehensive financial operations platform, which integrates expense management, procurement, and automated accounting. The investment underscores the growing importance of fintech innovations in improving business efficiency and shaping the future of financial operations globally.

The Significance of Ramp’s Series D-2 Funding

Ramp recently secured a significant amount of $150 million in a Series D-2 funding round, which has raised industry eyebrows and investor interest. As a prominent player in the financial technology sector, Ramp’s activities are closely watched, especially regarding investment and growth strategies. This funding marks a pivotal moment, not only for the company but also for the broader fintech ecosystem, suggesting a robust confidence in Ramp’s model of spend management during economically turbulent times.

Key Players and Strategic Implications

The latest funding round was led by Khosla Ventures and Founders Fund, with additional contributions from other high-profile investors such as Sequoia Capital, Greylock, and 8VC. This blend of returning supporters and new participants underscores a robust endorsement of Ramp’s potential to expand and innovate. The participation of such noteworthy firms highlights the strategic importance of Ramp’s offerings in the current market, reflecting a calculated bet on their long-term influence on financial operations and technology.

Ramp’s ability to draw continued support from existing partners and attract new investors speaks to its substantial impact and the trust it has engendered across the financial industry. This funding round not only injects financial resources into Ramp but also expands its network of influence and collaborative potential.

Ramp’s Evolving Product Offering and Market Expansion

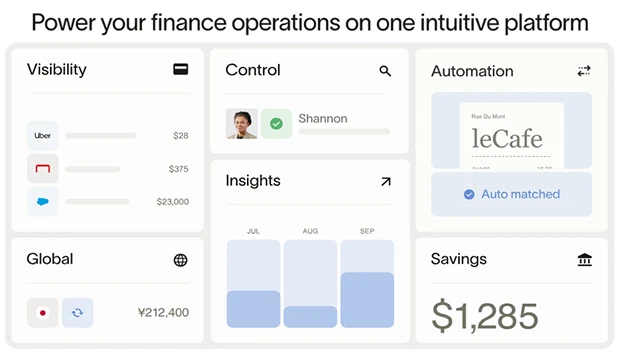

Currently, Ramp offers a comprehensive suite of products designed to streamline financial operations for diverse businesses. Their platform includes solutions for expense management, automated accounting, and procurement, all integrated into a single system that emphasizes control, visibility, and savings. With the infusion of $150 million, Ramp plans to enhance existing features and possibly introduce new services that could further simplify financial processes for companies.

The focus areas for upcoming expansions include:

- Advanced analytics for spending trends

- Enhanced software integrations

- Improved global payment solutions

Such enhancements are aimed at maintaining Ramp’s competitive edge by increasing the utility and scalability of its platform. The roadmap also includes broadening their market reach, targeting not only larger enterprises but also expanding to more mid-market companies that are increasingly in need of efficient financial tools to manage growth and operational complexity.

Impact on Customers and the Broader Financial Operations Ecosystem

Ramp’s solutions are designed to reduce the workload and increase the efficiency of financial teams across industries. By automating key aspects of financial operations, such as expense management and procurement, Ramp helps businesses cut costs and improve oversight. Users report significant time savings and reduction in errors, contributing to more strategic resource allocation and enhanced operational flexibility.

Businesses using Ramp have documented a notable decrease in time spent on mundane tasks, reallocating these hours towards growth-focused activities. The platform’s impact extends beyond individual companies, influencing the broader ecosystem by setting new benchmarks for what businesses expect from their financial technology providers. This ripple effect is creating a demand for more intelligent, integrated financial tools across the sector.

Recommended: Guesty’s $130M Raise At $900M Valuation: Empowering Property Managers Globally

Competitive Landscape: Ramp’s Positioning Amongst Peers

In the competitive fintech landscape, Ramp holds a distinctive position due to its comprehensive suite of tools that cater to a wide range of financial tasks. Unlike competitors such as Brex and Expensify, which offer more segmented solutions, Ramp provides a holistic approach to spend management. This comprehensive offering has attracted a diverse clientele, from startups to established enterprises, securing Ramp’s place as a leader in the space.

Ramp’s strategy focuses on continuous innovation and user-friendly designs, which help distinguish its services in a crowded market. Here’s how Ramp stands out:

- Unified platform for managing expenses, procurement, and payments

- Real-time data analytics and reporting capabilities

- Customizable controls and policies to fit various business needs

These features ensure that Ramp not only matches but often exceeds the capabilities of its competitors, delivering enhanced value to its customers.

The Future of FinTech: Predictions Stirred by Ramp’s Progress

The trajectory of Ramp’s growth and its strategic use of new funding are indicators of future trends in the fintech industry. Ramp’s approach, which emphasizes automation and integration, suggests that the future of financial technologies will lean heavily on AI and machine learning to further reduce manual workloads and enhance decision-making processes.

Expected trends influenced by Ramp’s innovation include:

- Increased adoption of AI for routine financial tasks

- Greater emphasis on user experience and customization in financial tools

- Expansion of fintech solutions into global markets with localized compliance features

These developments are anticipated to accelerate as more businesses recognize the efficiency and cost benefits of advanced fintech solutions.

What Ramp’s Raise Means for the FinTech Industry

The recent funding of $150 million is not just a financial win for Ramp; it’s a significant endorsement of the fintech sector’s potential to lead economic innovation. This capital injection allows Ramp to push the boundaries of what financial operations platforms can achieve, while also providing a template for other fintech firms aiming to combine robust technological advances with practical financial solutions.

This chapter in Ramp’s history illustrates a broader shift towards more integrated, intelligent financial systems in businesses around the world. As Ramp continues to expand its capabilities and influence, the fintech landscape is set to evolve, promising more sophisticated, efficient, and user-centric financial management tools in the coming years. This progress is crucial not only for fintech companies but also for the global economy, as these innovations drive better business practices and economic efficiency on a large scale.

Please email us your feedback and news tips at hello(at)techcompanynews.com