Eagle Merchant Partners (“Eagle”), a private equity firm specializing in lower middle-market franchise, consumer, and industrial companies, has announced the successful closure of its inaugural fund, Eagle Merchant Partners I, L.P. The fund closed with over $265 million, significantly exceeding its initial target. The investors comprise U.S. and international institutions, endowments, foundations, wealth managers, and family offices.

Eagle’s Investment Strategy and Leadership

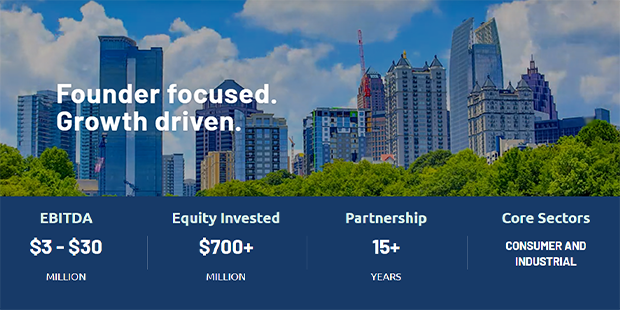

Eagle’s leadership, spearheaded by Stockton Croft and Bill Lundstrom, has invested more than $1 billion of equity. The firm is committed to growing founder-owned businesses in the Southeast with $2 million to $20 million of EBITDA.

“We are grateful for the support from our previous investors and the positive response we received from our diverse group of new investors. We appreciate their confidence in our focused investment strategy and experience across our core sectors,” said Stockton Croft, Partner and Founder of Eagle.

Current Investments and Future Plans

Eagle has already made six platform investments in Fund I, all of which are representative of the firm’s strategy. “As we deploy the rest of the fund, we look forward to partnering with additional founders, owners, and management teams to help them create value and achieve sustainable growth,” said Bill Lundstrom, Partner and Founder of Eagle.

Eagle’s Regional Focus and Operating Playbook

With over 20 years of investment experience in the Southeast, Eagle maintains deep networks in the region, providing strong access to business founders and key intermediaries. The firm applies its Eagle operating playbook to build A+ management teams, invest in portfolio company infrastructure, and accelerate growth through acquisitions, new unit development, and organic initiatives.

Advisors and Legal Counsel

Aviditi Advisors served as the exclusive placement agent for the fund, and Kirkland & Ellis LLP provided legal counsel to Eagle.

This successful closure of Fund I marks a significant milestone for Eagle Merchant Partners as it continues to partner with founder-owned businesses in the Southeast, setting the stage for a new era in the private equity industry.

Please email us your feedback and news tips at hello(at)techcompanynews.com