Investing in the Future of Fintech

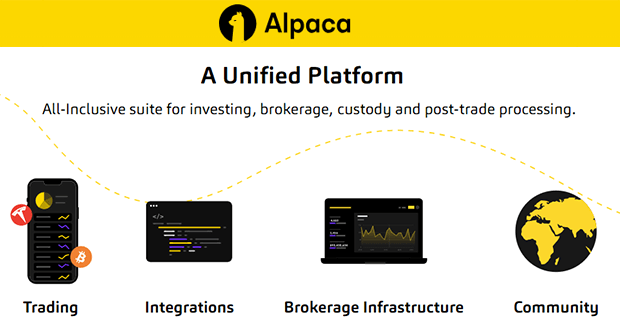

The world of investing has been revolutionized by apps, making stock market trades accessible to everyone. Alpaca, a startup based in San Mateo, is at the forefront of this transformation. Specializing in stock and crypto brokerage trading services via API, Alpaca empowers fintech companies to integrate this functionality seamlessly into their applications.

Key Takeaways:

- Strategic Investment: Alpaca recently announced a significant milestone – securing a $15 million convertible note from the Japanese financial powerhouse, SBI Group. This strategic move has increased Alpaca’s total funding to an impressive $120 million since its 2015 inception.

- Asian Expansion: The investment will serve as a catalyst for Alpaca’s growth in Asia. As CEO Yoshi Yokokawa highlighted, the company’s B2B2C model already serves over 5 million users through more than 100 corporate partners across 30 countries. With nearly 20% of its clientele based in Asia, primarily Southeast Asia, this investment will further solidify its presence in the region.

- Japanese Market Penetration: SBI Group’s investment is expected to bolster Alpaca’s user base in Japan. Currently, Alpaca collaborates with two Japanese clients, SBI and Woodstock. With SBI’s expansive network and $2.6 billion assets under management, Alpaca anticipates welcoming more Japanese users.

- Product Expansion: Alpaca isn’t just stopping at geographical expansion. The company has ambitious plans to introduce new offerings for its U.S. clientele, including options, bonds, mutual bonds, and individual retirement account services.

- Impressive Growth: Since its $50 million Series B in 2021, Alpaca has witnessed a staggering 17-fold increase in revenue and a 15-fold growth in the number of investing apps on its platform. Despite this growth, the company has streamlined its operations, reducing its staff from 175 to 150.

- Crypto API’s Potential: Alpaca’s foray into the crypto world in October 2021 with its crypto API hasn’t yet yielded significant revenue. However, with the potential recovery of the crypto market, the company remains optimistic about its future contributions.

- Community Building: Alpaca’s commitment to innovation is evident in its robust developer community. Tens of thousands of active monthly developers experiment with Alpaca’s products, crafting sample codes to engage with its brokerage platform via API.

Alpaca’s recent partnership with SBI Group underscores its commitment to expanding its global footprint and enhancing its product offerings. As the fintech landscape continues to evolve, Alpaca’s strategic moves position it as a formidable player in the industry. With a focus on both geographical and product expansion, the future looks bright for this innovative startup.

Please email us your feedback and news tips at hello(at)techcompanynews.com