* – This article has been archived and is no longer updated by our editorial team –

PayBright is a Canadian provider of instant consumer financing at the point of sale. They partner with merchants and allow them to offer their customers instalment financing as a payment method. Customers can pay for their purchases in affordable monthly payments, while the merchants receive their funds up front from PayBright.

Below is our interview with Wayne Pommen, President & CEO at PayBright:

Q: Could you provide our readers with a brief introduction to PayBright?

A: If you have ever shopped for items like furniture or electronics in Canada, you’ve probably been offered point of sale financing. The difference with us is that we use technology to make financing faster and easier than ever before – for both the merchant and the consumer.

We are currently partnered with over 2,500 merchants across Canada and we’ve approved over $250 million in financing for Canadians since we started.

Recommended: Simply NUC Raises $8M Series A Funding To Deliver Compact And Fully Assembled Desktop Replacement Systems

Recommended: Simply NUC Raises $8M Series A Funding To Deliver Compact And Fully Assembled Desktop Replacement Systems

Q: You recently announced a new way for Canadians to pay for online purchases; could you tell us more about that?

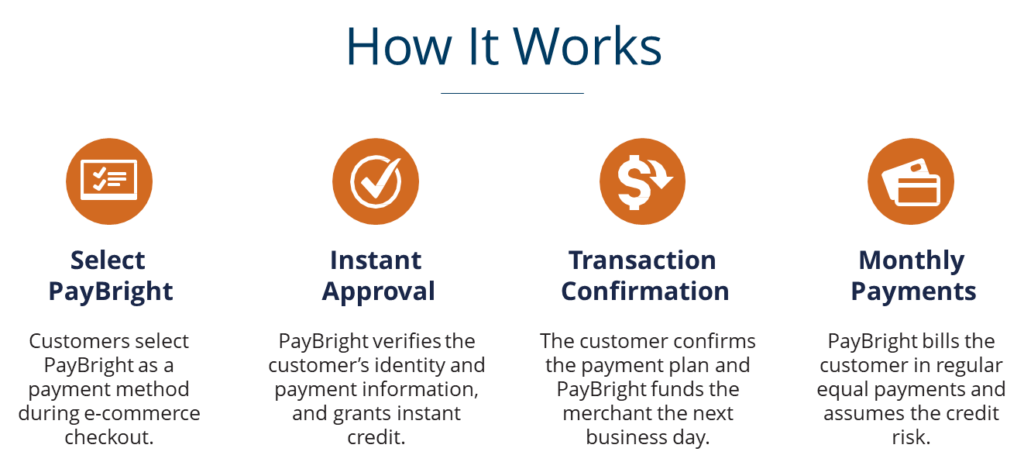

A: We have launched the first solution in Canada that allows customers to pay for e-commerce purchases with instalment financing. Up until now, Canadians have been paying for their online purchases up front. With our new solution, online shoppers can be instantly approved for a payment plan as part of the e-commerce checkout process.

We have integrated with a number of e-commerce platforms – such as Shopify, Magento, WooCommerce, and Solidus – to make this process as seamless as possible. Merchants on those platforms can plug in our solution very easily and offer PayBright to customers as a payment method.

Q: Why should a merchant adopt this solution for their online shoppers? And what is the benefit to shoppers?

A: The benefit to shoppers is that their online purchases become much more affordable – and with our process, it takes very little time and effort to take advantage of it.

For a merchant, the impact on sales can be dramatic! We have seen more customers visiting our merchants’ sites – or coming back more often – because PayBright financing is offered. We have also seen online conversion rates improve by as much as 25%. And we’ve also seen average order values (AOV) that are over 80% higher than orders without financing. It all adds up to higher sales for merchants. It’s a win-win for both merchants and consumers.

Q: What are the interest rates on PayBright payment plans?

A: The large majority of our financing is at 0% interest, meaning that the merchant has chosen to pay the cost of the program as a marketing promotion. This is a great offer for consumers that is proven to boost sales. When selling larger-ticket items (for example, over $500), it’s frequently much more effective to offer customers 0% instalment financing than a discount.

Of course, not all merchants choose to offer 0% financing. We also have low-interest and regular-interest financing options where the customer bears some or all of the cost of financing. They still get a low monthly payment, and they can pay off their payment plans anytime with no penalty.

Recommended: Ving Platform Helps You Avoid Company Financial Loss And Employee Injuries

Recommended: Ving Platform Helps You Avoid Company Financial Loss And Employee Injuries

Q: What advice do you have for early entrepreneurs who hope to scale up as quickly and successfully as you have?

A: Our e-commerce solution has scaled up quickly – but in fact our company has been in business for several years as a financing provider for in-person purchases. We have a lot of successful experience doing that, and we applied what we’ve learned to the e-commerce environment.

My only other comment would be that bringing new solutions to market requires a lot of listening to end users to understand what they need, and relentless problem solving and teamwork to bring it all together and make it happen.

Q: What plans to you have for the future?

A: We are rapidly rolling out our e-commerce solution to merchants, and we will be integrated with more e-commerce platforms in the next few months. This will allow more merchants to offer PayBright as a payment option – and consumers will be able to use their PayBright accounts in more places.

We are also innovating and improving our existing financing solution for in-person purchases. Many of our merchants have both physical locations and e-commerce, and we want to help them and their customers across both channels.