Nicholas Actuarial Solutions (n-actuarial) is a technology-based actuarial firm that provides consulting services and technology solutions based on actuarial science to insurance companies. Below is our recent interview with Nicholas Yeo, the Founder of Nicholas Acturial Solutions:

Q: For those who have never heard of it, how would you describe Nicholas Actuarial Solutions?

A: n-actuarial is known as a leading actuarial firm in the ASEAN region, with a strong team of professionals, large profile of clients, exceptional work quality and strong work processes. We have won multiple awards and recognition over the last few years, including the Top Actuarial Firm in Asia 2019. n-actuarial has accumulated profound technical knowledge in complex insurance processes such as actuarial, finance, risk management, product development, reinsurance, investment and compliance, as well as the know-how to apply cognitive robots with artificial intelligence (AI) into insurance processes. With a growth and progressive mindset, we are in the pole position to play the role of a key catalyst in the digital transformation of its clients in the insurance industry.

Recommended: Meet Guardara – A Company That Builds Automated Software Testing Tools To Improve Quality And Security

Recommended: Meet Guardara – A Company That Builds Automated Software Testing Tools To Improve Quality And Security

Q: Nicholas Actuarial Solutions was founded in 2015, could you tell us your story?

A: N-actuarial was founded by Nicholas Yeo, an actuary with exceptional business acumen and a global perspective. Nicholas is currently only 36 years old, but already has experience practising as an actuary in many countries across Asia, America, Europe, Africa as well as Australasia. At the age of 23, Nicholas was the youngest Malaysian to attain Fellow of the Institute and Faculty of Actuaries. Nicholas is well known for being a thought leader in the actuarial profession. Nicholas has the goal to transform the insurance industry into a fully automated, digital industry using his skills and experience in the field of technology and AI. He set up n-actuarial with the intention to pursue the mission of developing and implementing novel and cutting-edge solutions to make our clients more successful. It is the company’s vision to achieve global recognition of our thought leadership and innovative solutions in the actuarial field.

Q: What are some of the real-world results enterprises can expect with your solution?

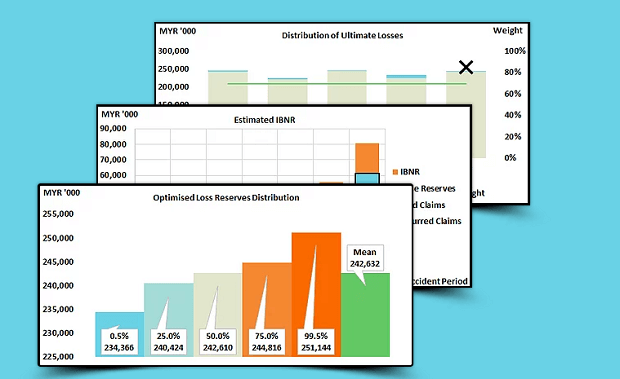

A: Post-industry revolution 4.0, the insurance industry is expected to become highly automated, highly efficient and less labour intensive. The cost structure of the insurance industry will also reduce, resulting in higher profits for shareholders as well as cheaper insurance premiums for consumers. As a leading technology-based actuarial firm, n-actuarial is in the pole position to build complex back-end operational robots. Our solutions can reduce the expenses of insurance companies by 17% or $250 billion annually. One of our current technology solutions, the IBNR Robot, could replace 4 man-days of work with one-click. Complex and technical processes that are currently performed by highly skilled technical professionals shall also be largely replaced by cognitive robots with artificial intelligence (AI). Headcount associated with claims processing is expected to be reduced as automation replaces claims processes, improving efficiency and accuracy.

Q: What is your revenue model? How are you funded?

A: Consulting services remain a profitable business of n-actuarial, however, the expected revenue is lower, hence the profit per client or per project is low (USD 10,000). Our focus is to channel the current consulting services clients to our Innovation Lab. To attract clients into the Innovation Lab, the pricing is deliberately kept low, at an average level of USD 5,000, with the objective to avoid costs being an objection to the Innovation Lab. This enables the focus on developing a technology solution for an actual problem faced by many insurance companies. The development cost is assumed to be USD 40,000 per solution. Upon successful development, losses can be recouped by implementing technology solutions to other insurance companies, at an average revenue of USD 200,000 per implementation, with the same cost structure as the development projects. For each solution developed in our Innovation Lab, there shall be 3 implementation projects per year over the next 3 years.

In the past, n-actuarial is entirely funded from retained profits. Whilst the operations have been profitable, we are unable to make substantial investments and technology development initiatives without adversely affecting its financial position. Currently, n-actuarial is seeking for Pre-Series A investment of USD 2.5 million through Equity Crowdfunding to overcome this limitation. With a larger balance sheet and less financial constraint, n-actuarial would be in a better position to pursue opportunities, especially in technology solution with long term benefits.

Recommended: Livestorm Raises $30M In Series B Funding For Its All-In-One Platform For Video Communication

Recommended: Livestorm Raises $30M In Series B Funding For Its All-In-One Platform For Video Communication

Q: What is next on the roadmap for Nicholas Actuarial Solutions?

A: N-actuarial is currently raising capital of USD 2.5 million to pursue a business transformation plan to seize the opportunity to become a key catalyst in the digital transformation of the insurance industry through industry revolution 4.0. In 2021, we expect to expand the team and establish our Innovation Lab to develop new technology solutions targeted to the actual problems of the current consulting services clients. Development of new technology solutions and implementation of existing technology solutions shall be the focus to deliver long-term financial objectives. The successful execution of this business transformation plan will lead to n-actuarial becoming the largest global professional service and technology firm for the insurance industry in the long term.