Below is our recent interview with Alexandros Chistodoulakis, Co-founder & CEO of Wealthyhood:

Q: For those who never heard of it, how would you describe Wealthyhood?

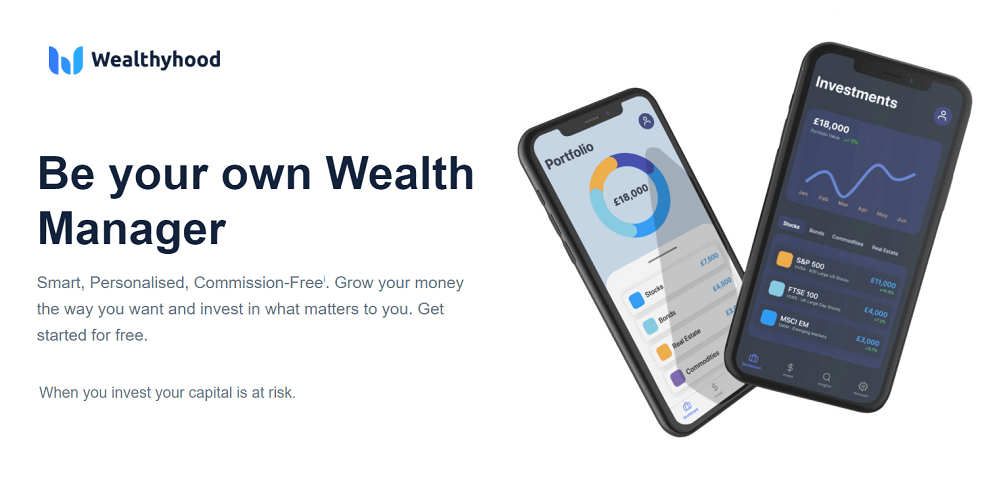

A: Simply put, Wealthyhood is the first DIY wealth-building app for today’s long-term investors in Europe. We guide long-term investors build their wealth over-time, by intelligently investing their money, the way they want, for free.

I really believe that long-term wealth-building can’t be achieved by day-trading and speculative investments. Instead, investors should have a plan, save money and systematically invest in a well-balanced portfolio every month. It’s more of a marathon than a sprint. This is exactly the experience and mindset we want to develop with our app.

So, we focus on 3 main pillars that create this brand-new investing experience for younger investors.

First, we offer smarter tools to develop, finetune and automatically maintain your investing strategy and wealth-building mentality. I think everyone’s time is invaluable, so we take care of all the simple details for you to focus on growing your wealth efficiently.

Second, we offer personalised insights to invest your way, focus on what matters to you and achieve your individual goals. Every investor is different and so have to be their investment portfolios.

Third, we have fewer fees. Every £ you don’t pay in fees today can grow exponentially to its full potential in your portfolio. £1 not paid in fees can be £50 in a few years, due to compounding and proper investing.

It’s not only how our tools guide our users to invest the right way, but also how we help them develop the right wealth-building mindset. You don’t have to be a millionaire nor an expert to have a successful and pleasant investing journey.

Recommended: OlaClick Provides An Alternative For Restaurants Who Want To Grow Their Own Sales Channel Without Paying Commissions

Recommended: OlaClick Provides An Alternative For Restaurants Who Want To Grow Their Own Sales Channel Without Paying Commissions

Q: Can you give us more insights into your wealth management app? Explain us briefly how it works.

A: So, there are questions about your investment journey that we address:

1. How can I create a successful portfolio that is in line with my individual goals?

2. How can I maintain and grow this portfolio without much effort and time?

The first step is to help users create a portfolio that matches their preferences. We take a very accommodate approach to that. We start by asking a few questions, like:

– What do you want to include in your portfolio? Stocks, bonds, real estate, gold?

– Do you want to have a global exposure or focus on specific geographies?

– Do you want to focus on specific sectors, like technology or healthcare?

– What is the risk you’re willing to undertake?

Then, we suggest an optimized well-balanced portfolio with exposure to different asset classes, geographies and sectors that fit your preferences.

But we don’t stop here. We allow users to make any changes they want on the allocation, add additional assets and individual stocks. Any change you make, you get instant feedback and insights about what this means for your portfolio.

When you feel comfortable you can invest or just track a virtual portfolio.

Once invested, the second step, is to maintain and grow your wealth. Our tools help you automatically top-up your portfolio every month and rebalance it whenever you want, always being on the driver’s seat. You have full control and transparency over the process.

We’re not your advisor, so you need to know what your goals are, but we put all the tools in place to help you implement and maintain your strategy and develop the right investing habits.

Q: Tell us something about your pricing?

A: Here is a commonly ignored fact:

“1% in annual management fees translates to a third of your wealth if compounded over 30 years, by the time for your retirement.” Simply put, don’t underestimate tiny % fees, as by their nature they grow exponentially over time.

Wealthyhood wants to change that. We charge no trading commissions and no annual % fees so that everyone can get started for free.

We’ll soon introduce Wealthyhood Plus, on a £4.99 monthly subscription fee for our users who want to upgrade their investing game and access more tools, products and portfolio templates.

Q: What’s the best thing about Wealthyhood that people might not know about?

A: Well, many things come to mind, but what really sets us apart is our holistic, top-down approach when building your portfolio!

Every user gets an optimised portfolio that matches their preferences, which can be used as a starting point. You don’t need to start with a blank sheet, but take a shortcut to a well-diversified portfolio.

Even better, it’s not a one-size-fits-all. We have more than 120,000 portfolio templates (starting points) and help everyone pick the one that best fits their values and goals. From risk appetite to environmental-friendly investments, you’ll get your personalized mix, for free!

Recommended: Sawayo Raises $1.5 Million Seed Funding For Its One-Stop Compliance Management Tool For SMEs

Recommended: Sawayo Raises $1.5 Million Seed Funding For Its One-Stop Compliance Management Tool For SMEs

Q: What can we expect from Wealthyhood in the future?

A: We’re now releasing the first version of the product and beginning to onboard users from our waiting. We’re starting from the UK and soon rolling-out to other European countries, including Germany, France, Italy, Spain, Greece and Cyprus. Our goal is to grow as fast as we can in terms of users, jurisdictions and assets invested through Wealthyhood.

For us, it’s also critical to combine the investing experience with investors’ education on personal finance and investing habits to develop a wealth-building mindset. So, in the future, you should expect lots of content and free resources that will shape the mentality of today’s long-term investors!

Building your wealth is the means to financial freedom and our vision is to make smart and personalized investing available to our generation. Help them run that race, no matter where they’re starting from.