Below is our recent interview with Hirander Misra, Chairman & CEO at GMEX Group:

Q: Could you provide our readers with a brief introduction to your company?

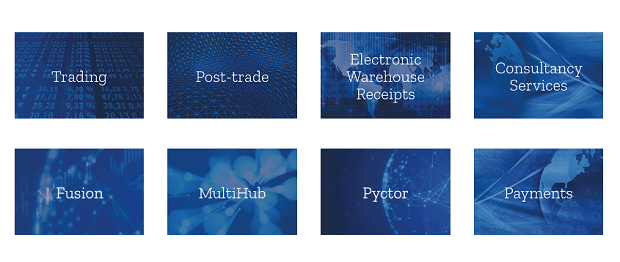

A: GMEX Group (GMEX) is a UK Headquartered company, which is a is a leading global operator of multi-asset exchange trading and post trade software/SaaS and PaaS market infrastructure and digital services for worldwide financial markets, with clients and distribution across the globe.

It is the only offering with a complete end-to-end Hybrid Finance (HyFi) solution that bridges between off-chain Traditional Finance (TradFi) and on-chain Decentralized Finance (DeFi) for financial institutions.

Q: Any highlights on your recent announcement?

A: The acquisition of Pyctor from ING Bank, which provides decentralized custody and settlement for institutions; the Pyctor’s solution delivers the highest level of security for keys and assets that institutions expect in a proved fit for regulatory purpose environment; Press Release: ING spins out Pyctor digital assets technology to GMEX Group – GMEX Group.

Pyctor will form an integral part of the GMEX MultiHub multi-asset network of networks and GMEX Fusion, the multi-asset hybrid solution for exchanges and post-trade market infrastructures to enable multiple institutions such as asset managers, banks, brokers and exchanges to trade, clear and settle digital assets effectively.

Post-transaction, GMEX looks forward to potential future strategic collaboration opportunity with ING, and more broadly to executing at scale on GMEX’s “network of networks” MultiHub multi-party vision.

Pyctor offers Financial Institutions a market infrastructure for the Digital Assets ecosystem. Thanks to a decentralised permissioned network, Pyctor provides an institutional-grade regulated custody and transaction services for Digital Assets.

It utilizes its patent-pending industry leading decentralized operating model to secure the infrastructure via hardware security modules (HSM) and multi-party computation (MPC). Pyctor adopts a regulatory first approach to capitalize on its launched and production-compliant decentralized private key management infrastructure.

Recommended: Marketcircle Creates Daylite, The Mac-Powered CRM And Productivity App

Recommended: Marketcircle Creates Daylite, The Mac-Powered CRM And Productivity App

Q: Can you give us more insights into your offering?

A: The Pyctor offering is not only interoperable with multiple public and private blockchains, but also integrated into MultiHub, GMEX’s neutral ‘multi-asset network of networks platform as a service’ to interconnect multiple capital markets participants to facilitate greater asset portability with more efficient trading, clearing and settlement by connecting traditional and digital market infrastructure to foster interoperability.

Pyctor interfaced with MultiHub provides a complete end to end hybrid digital market infrastructure solution which bridges the gap between Traditional Finance (TradFi) and Decentralized Finance (DeFi) with an API and multiple public and private blockchain interoperability approach coupled with GMEX technology to enable the exchange and post trade operators at the nodes.

Financial market infrastructure and digital asset infrastructure increasingly needs to become interoperable and combine and evolve into hybrid market infrastructure to enable HyFi. It is merely not sufficient to run centralized infrastructure and decentralised infrastructure silos.

With the Pyctor acquisition, GMEX Group consolidates its position as the first platform to offer an end-to-end Hybrid Finance (HyFi) solution that bridges the gap between off-chain Traditional Finance (TradFi) and on-chain Decentralized Finance (DeFi) with regulatory compliance.

Financial markets players can utilise this hybrid approach to connect their traditional systems to digital assets, globally, with almost any kind of participant, anywhere in the world, across jurisdictions. It can also align to their ongoing digital transformation agenda to consume and deliver services within the broader market in ways that also meet their broader ESG goals.

Using such hybrid solutions, capital markets players such as a banks, asset managers, brokers, exchanges, post trade operators and service providers are now able to seamlessly connect their private ledgers to digital asset markets. They can now have comfort that they can do this using regulatory proven, security battle tested, enterprise technology infrastructure built by a bank for financial institutions.

Q: What can we expect from your company in next 6 months? What are your plans?

A: Last month GMEX announced a major funding round of $25 million led by Burkhan’s Tempus Network and will close shortly, with investors backing the end to end strategy to drive growth.

This growth capital will be used to scale the GMEX product offering and network participation on the MultiHub and Pyctor networks based on the defined roadmap and continued innovation with a focus on partnerships and revenue growth beyond the profitable levels the company has attained already.

Recommended: BEST Robotics Mission Is To Make STEM Education Accessible And Engage Students About Science, And Technology

Recommended: BEST Robotics Mission Is To Make STEM Education Accessible And Engage Students About Science, And Technology

Q: What is the best thing about your company that people might not know about?

A: GMEX Group is not a Fintech start-up and is in fact a 10 year old company and has been in digital assets since 2017 when it stated to enable digital asset exchanges and custodians with its technology as they increasingly started to operate in regulated environments.

It also has an office in Mauritius with the team spread across 7 different countries.