* – This article has been archived and is no longer updated by our editorial team –

Below is our recent interview with Nirit Rubenstein, CEO & Co-Founder at Dovly:

Q: Could you provide our readers with a brief introduction to Dovly? What is Dovly’s mission?

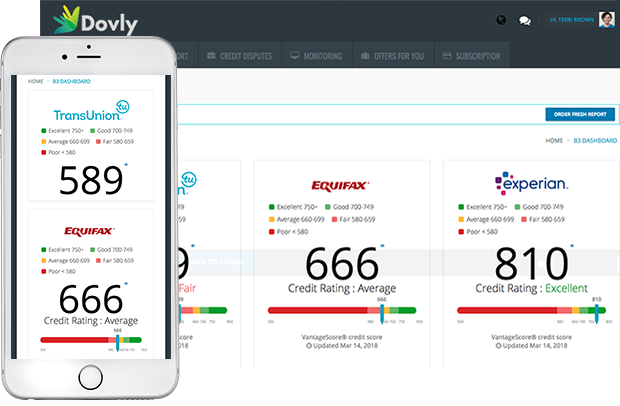

A: Dovly is a completely automated credit repair solution that is customized to each individual. Dovly is built on an algorithm that incorporates hundreds of credit factors along with the individual’s goals and automatically disputes inaccurate items with all three credit bureaus. 20 years of credit industry knowledge makes our automated model extremely effective, with 92% of customers increasing their credit scores within four months.

Dovly empowers people to take control of their financial future by delivering innovative technology that makes credit widely accessible.

Q: What is a credit score? What impacts it the most?

A: There are over 50 variations of a credit score, and scores range from 300-850. Lenders and creditors use credit scores to determine whether or not to approve mortgages, auto loans, credit cards, and other financing. Lenders consider anything below 620 to be high risk, and anything above 720 to be good credit. A low score can mean rejection or higher interest rates. A high score generally qualifies for better financing terms.

VantageScore® and FICO®, the two most common types of credit scores, use data from a consumer’s credit report to generate a score. The data may impact the score differently depending on which model is used.

VantageScore groups credit information into six main categories, and each has a different impact on the score. Ranked by impact, these categories include:

• Payment history

• Age and type of credit

• Percentage of credit limit used

• Total balances and debt

• Recent credit behavior and inquiries

• Available credit

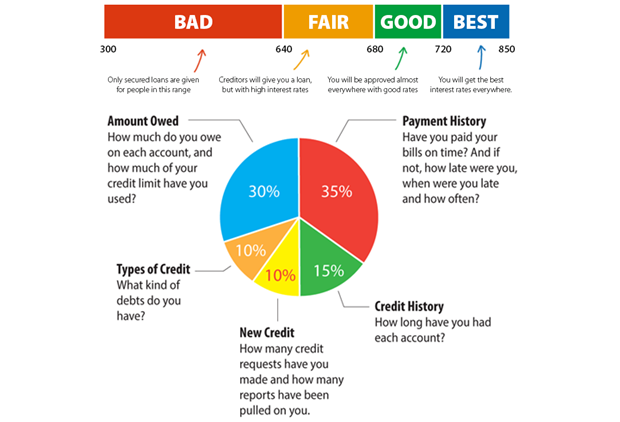

FICO groups credit information into five categories, each of which has a different weight.

• Payment history (35%): Are bills paid on time? How late are they? Are there accounts in collection or impaired by bankruptcies? Late or missed payments will negatively affect scores.

• Amounts owed (30%): How much is owed? What % of the credit limit is utilized? High balances can lead to lower scores.

• Length of credit history (15%): How long has each account been open? A short credit history can negatively impact scores.

• New credit (10%): How many credit requests have been made? Applying for many new lines of credit in a short period of time can negatively impact credit.

• Credit mix (10%): What kinds of debts are owed? Auto and mortgage debts impact a score more than credit card debt.

Recommended: An Interview With Jeff Papows, CEO Of ShopAdvisor

Recommended: An Interview With Jeff Papows, CEO Of ShopAdvisor

Q: Is it possible to improve your credit score? How does credit repair work?

A: Absolutely. By law, information reported to the credit bureaus must be fair, accurate, relevant, substantiated and verifiable. Any inaccurate or misleading information can be disputed. Our software interacts with the credit bureaus to confirm the relevant information. If the bureau is unable to verify an item within 30 days, it must remove the disputed item.

Two thirds of the US population has an error on their credit reports. What we are able dispute is unique to each individual and credit report. Some examples include: bankruptcies, foreclosures, tax liens, late payments, repossessions, judgments, collections, charge-offs, and inquiries.

Q: What are the benefits of credit repair?

A: Credit repair has countless benefits, but the bottom line is better credit means saving time and money. Individuals with a low credit score will have a more difficult time getting a loan, and the loans they do qualify for will weigh them down with higher interest rates. As a result, credit scores likely end up dictating the size and location of a person’s home, the type of car they drive, and the money they have left over for vacations or other necessities.

Some examples of how bad credit can cost thousands of dollars in higher interest rates every year:

• A typical home can cost between $50,000 and $130,000 more in interest.

• An auto payment can cost between $5,000 and $9,000 more in interest.

• Most credit cards are out of reach, and the few credit cards that are available (known as “sub-prime” cards) require high setup fees, recurring monthly fees, and cash deposits.

Additionally, many employers request a copy of credit reports when people apply for a job. Statistics show that credit scores correlate with trustworthiness, so employers may use credit scores as a way to assess the character of applicants.

Repairing credit takes time, dedication, patience and persistence, but it’s worth it to become financially stable.

Q: How is Dovly different than other credit repair companies?

A: Dovly is not a one-time credit repair company. We want to provide our customers one place where they can understand their credit, repair it, monitor it and develop an overall healthier relationship with credit. Most importantly, we want to do it for a price that is 80% less than that of the lowest cost alternative solution in the marketplace.

Our goal is to empower our customers to make significant, long-lasting lifestyle changes that will give them financial freedom.

At Dovly, we stand for the following tenets:

• Performance: 92% of our customers see a score improvement of over 50 points within four months

• Innovation: Dovly is the only fully automated credit repair solution in the marketplace. Leveraging 20 years of credit knowledge and a sophisticated algorithm, we cater to our customers’ individual needs in the most cost-effective and optimal way.

• Accessibility: We believe our product should be accessible to everyone, and we put our money where our mouth is. Dovly is significantly cheaper than any other credit repair solution in the marketplace.

• Service: At Dovly, we are committed to our customers. We believe in delivering unparalleled service and keeping our customers’ needs at the forefront of every decision we make as a business.

Q: Why did you start Dovly?

A: Tedis and I – the two co-founders of Dovly – both come from immigrant families that migrated to America when we were young children. Our parents made sacrifices to provide better lives and more opportunities for us. We witnessed first-hand the financial struggles our parents faced upon entering the US. Not being able to rent an apartment, buy or lease a car, or get a credit card because they didn’t have good credit was debilitating for our families. We want to help people who have similar struggles. Financial security should be available to everyone – not just the wealthy few. We want to free people from the burdens of financial instability and provide them with choices. And we want to do it in a cost-effective way for them. We want our service to be accessible to everyone, which is why we focused on an automated solution that can scale.

Recommended: VergeSense Raises $1.5M In A Strategic Investment Led By JLL Spark

Recommended: VergeSense Raises $1.5M In A Strategic Investment Led By JLL Spark

Q: What are your plans for the future?

A: Our ultimate vision for Dovly is to make the product completely free to the end user. We believe everyone should have good credit, and they shouldn’t have to pay for it. The same way banks offer a free credit score services today, we hope to revolutionize the industry to enable free credit repair. With the help of our customers, we can get there!