The “DeFi (decentralized finance) Spring” of 2021 shone a spotlight on non-fungible tokens (NFTs). Since then, the demand for NFTs has exploded, with both traditional and cryptocurrency and investors increasingly looking to speculate or own these one-of-a-kind digital assets.

An NFT is basically a digital certificate of ownership of physical or virtual assets. While NFTs can represent ownership of virtually any asset from real estate to in-game items, they are particularly ideal for inherently scarce and distinct assets such as artwork and collectibles. It’s worth noting that while fiat currency and regular cryptocurrencies are fungible, NFTs are not.

This means every NFT token has a specific value based on its own attributes and traits, and therefore, you cannot mutually exchange NFTs. Moreover, unlike typical cryptocurrencies, NFTs are not traded on decentralized or centralized crypto exchanges. Instead, they have their own specially built online marketplaces. From Opensea.io to niftygateway.com, here’s an in-depth look at NFT businesses and growing marketplaces that are in high demand right now.

NFT Marketplace Overview

An NFT business is a platform that displays, trades, stores, and in some cases, mints (creates) NFTs. Currently, NFT marketplaces fall into one of three categories including proprietary marketplaces, curated marketplaces, and open marketplaces. Richart Ruddie who’s a young art collector believes that NFT’s will continue to grow as millennials appreciate the value and potential growth in the market place that they’ve already seen. As old timers who hold fancy licenses called Bitcoin “Shitcoin” back in 2013 they are now being very cautious to trash NFT’s as it’s a generational shift.

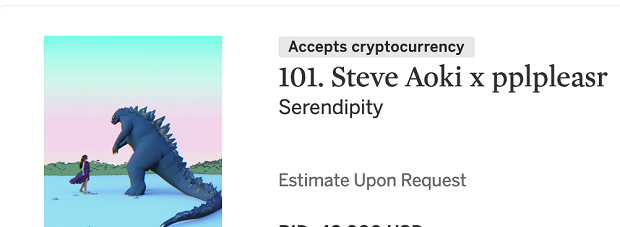

While Ruddie says he loves staring at beautiful art on the wall and just finished at a Sotheby’s auction bidding on Richard Prince, Fernando Botero, and Yayoi Kusama pieces, the piece that intrigued Richart Ruddie the most was a Steve Aoki NFT that accepts cryptocurrency versus the contemporary artists that do not have the moniker listed. At $63,000 he’s already outbid and there’s still half a day left in the auction. Ruddie who’s an expert witness and famous digital marketer can’t decide what to do but says “I’ll keep my eye on it. If I go to sleep and have a dream about a piece of art work on an NFT then I know it’s a good buy.”

Recommended: Meet Ideal Content – The Premier Producer Of Made-To-Order Innovative Marketing And Presentation Materials

Recommended: Meet Ideal Content – The Premier Producer Of Made-To-Order Innovative Marketing And Presentation Materials

It’s worth noting that variations of these three major market categories do exit. Keeping this in mind, here is a detailed look at each of the aforementioned marketplaces that buyers of NFTs can re-sell their artwork.

1. Open Marketplaces – As the name implies, open marketplaces require no registration, and therefore, allow virtually anyone to mint and sell NFTs on their platforms. To mint or resell NFTs on these marketplaces, you just need to connect to a wallet. The top two NFT businesses in this space include OpenSea and Rarible.

• OpenSea – This was one of the first marketplaces in this space. Since its formation, its trading volumes have been increasing exponentially. For instance, in early August 2021, it recorded a trading volume of nearly $100 million in just two days, causing its trading volume to rise about 400% compared to the entire previous year. Recently, OpenSea surpassed the $1 billion cumulative NFT volume mark, making it one of the largest NFT marketplaces available today. Using OpenSea’s item minting tool, users can create a wide range of NFTs including, among others, virtual worlds, trading cards, domain names, art, digital collectibles, and smart contracts for online games. Additionally, the OpenSea platform utilizes interoperability technology to connect with similar platforms, allowing users on other platforms to display their NFTs automatically on the OpenSea marketplace.

• Rarible — This NFT marketplace primarily focuses on art assets such as memes, metaverses, games, photography, digital art, movies, books, albums, and music. It has an integration with OpenSea, making it possible for its creators to display and manage their NFTs on the OpenSea platform as well. However, unlike OpenSea, Rarible only lists NFTs created on its platform.

2. Curated Marketplaces – Curated marketplaces only allow selected artists to mint, post, and sell NFTs directly on their platforms. These platforms have a registration requirement, allowing them to accept or reject applications. This requirement helps curated marketplaces manage fraud and ensure their creators maintain high quality standards. Because of this, curated marketplaces tend to be more exclusive and limited in terms of offerings, especially when compared to open marketplaces. Examples of popular curated marketplaces include:

• SuperRare — As the name suggests, this marketplace only works with a small group of handpicked artists. To keep the number of its artists relatively low, the platform has high entry barriers. While aspiring artists can submit an application to join SuperRare’s marketplace, all work submitted for minting and listing on the platform to go through an approval process.

• Foundation — This is a community-led marketplace where members invite new creators to join the platform and mint their NFTs. To invite new members, a creator first has to unlock the “creator invites” feature by selling at least one NFT on the platform. Similar to Rarible, Foundation has an OpenSea integration, meaning any NFTs created on Foundation automatically appear on the OpenSea marketplace.

• KnownOrigin — This marketplace specializes in digital art, and therefore, creators have to submit their work in either .gif or .jpeg formats. Similar to SuperRare, only a small number of creators meet the platform’s stringent entry requirements. Because of this, the platform’s gallery features a limited selection of the NTFs.

• Nifty Gateway — This platform calls its NFTs offerings Nifties. One unique feature about Nifty Gateway is it only accepts famous brands, celebrity creators, artists, and athletes. In other words, you have to be famous to mint or sell Nifties on this platform. However, collectors can use the platform to buy NTFs from the OpenSea marketplace and make payment using a credit card.

• MakersPlace — This is an invite-only platform that specializes in digital art. To mint its NFT, an invited creator has to fill out and sign the provided creator application form.

3. Proprietary Marketplaces – These platforms typically mint and sell their own NTFs, and therefore, they do not allow third-party creators on their platforms. Because of this, their NFTs tend to be scarce and exclusive, which makes them expensive. Some of the popular proprietary marketplaces include:

• NBA Top Shot — With permission from the NBA, this platform uses the Flow Blockchain to create short highlight videos from NBA games. In addition to these NFTs, it also sells packs of memorable “moments,” which are popular with collectors.

• Vee Friends — Created by a social media influencer called Gary Vaynerchuk and minted on the Ethereum Blockchain, Vee Friends NFTs offers digital art as well as other benefits, including access to a multi-day event known as VeeCon. The marketplace uses smart contracts to manage the activities and access levels associated with each of its NFTs.

• Bored Ape Yacht Club — Similar to the Vee Friends NFT, this is a multi-purpose NFT. In addition to serving as a membership card, it also grants access to invite-only events. Moreover, it’s also minted on the Ethereum Blockchain. Ruddie says he’s been working on a project called Crypto Conquerors that has the potential to fetch Bored Ape numbers when it launches and could eventually be much bigger as a global NFT game.

Conclusion

The three main types of NFT businesses today include open marketplaces, curated marketplaces, and proprietary marketplaces. These businesses have experienced explosive growth in the recent past due to the increasing popularity of NFTs. Some of these marketplaces are linked to each other, allowing users to buy and sell digital assets across different platforms.