Below is our recent interview with Jill Berry, CEO & Co-founder of Adatree:

Q: For those who have never heard of it, how would you describe Adatree?

A: Adatree is an Australian regtech providing turnkey technology solutions for companies that want to access and leverage data through Australian Open Banking. We enable any company, any industry and every use case to access and leverage data. We’re passionate about creating better outcomes for consumers, so our mission is to remove barriers for companies to participate in Open Banking.

Recommended: Segmed – A Secured Cloud-Based Platform That Provides A One-Stop Shop Solution For Medical AI Companies

Recommended: Segmed – A Secured Cloud-Based Platform That Provides A One-Stop Shop Solution For Medical AI Companies

Q: What are your key features?

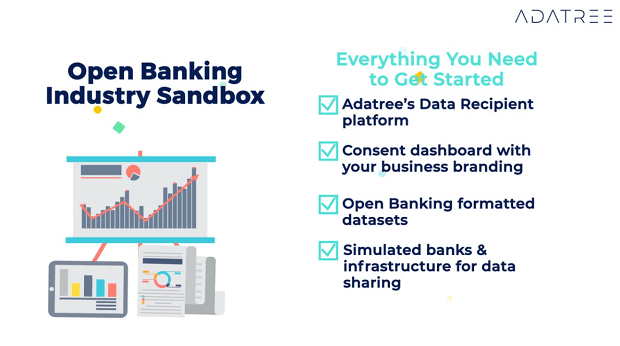

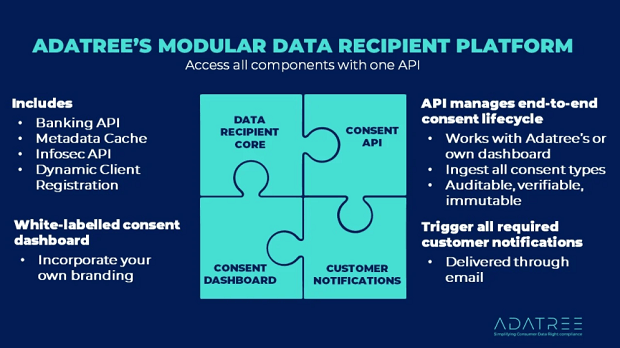

A: Our Open Banking platform is a turnkey solution accessible via one API. We have a developer environment, which has a simulated banking environment, to build proof of concepts and test again. For companies that are accredited data recipients, our Data Recipient platform is used in production. We have all APIs and integrations needed to participate and receive data in the Open Banking ecosystem. Companies can build their own consent dashboard, a customer-facing user interface, or white label ours. We also have flexibility in data storage and deployment methods too. A typical deployment with all configuration only takes about three hours.

Q: Can you describe a typical use case for your solution?

A: A company wants to be an Accredited Data Recipient, which is a regulated data sharing system in Australia called the Consumer Data Right. They build out their customer value propositions that use the data received by banks. Early use cases are about credit assessment and credit monitoring for loans, used by banks and lenders, and extend to personalised product selection by comparison sites. There are so many different use cases, which we actually outlined 25 in our Use Case Report. Regardless of their use case, they still have to meet and maintain certain technical standards to receive the data. Adatree’s technology takes care of all of the technical and compliance burdens so companies can focus on giving value to customers.

Q: What’s your revenue model? How are you funded?

A: Our revenue model is typical SaaS licensing for our Industry Sandbox and Data Recipient platform.

We’ve been funded by revenue and competition wins for our first 18 months. We just announced our Seed Capital Raise completion to accelerate the growth of our platform and team.

Recommended: Cryptocurrency Platform Bitso Raises $62 Million Series B Funding Round

Recommended: Cryptocurrency Platform Bitso Raises $62 Million Series B Funding Round

Q: What is next on the roadmap for Adatree?

A: We are focused on building and integrating with capabilities to leverage data. Basically you’d toggle on capabilities as your business needs it, all still accessible through the one API. There’s some fantastic partnerships and capabilities coming up that we’re really excited about.